YUM! BRANDS, INC. 4https://stories.starbucks.com/stories/2022/starbucks-global-environmental-and-social-impact-report-2021/

5 https://www.asyousow.org/report-page/plastic-pollution-scorecard-2021/

6https://corporate.mcdonalds.com/corpmcd/our-stories/article/renewable_packaging.html

SUPPORTING STATEMENT:

The report should, at Board discretion:

∎ | |  | | | Assess the reputational, financial, and operational risks associated with continuing to use substantial amounts of single-use2024 PROXY STATEMENT plastic packaging while plastic pollution grows;

|

∎ | | Evaluate dramatically reducing the amount of plastic used in our packaging through transitioning to reusables; and

|

∎ | | Describe how YUM! Brands can further reduce single-use packaging, including any planned reduction strategies or goals, materials redesign, substitution, or reductions in use of virgin plastic.

|

What is the Company’s Position Regarding this Proposal? Statement in Opposition to Shareholder Proposal Our Board of Directors unanimously recommends that shareholders vote AGAINST this proposal, as it would divert time and resources that the Company has determined would be better used to support our strategic business objectives. Our scale is one of the key differentiators leveraged by the Company and its Brands in driving consistent results over many years. Through its Brands, the Company system includes over 58,000 restaurants in more than 155 countries and territories around the world. The scope and diversity of our business allows us to effectively perform in a dynamic marketplace, in a way that would be significantly more difficult for any of the individual Brands to do if they were not part of the combined YUM system. The competitive advantages from our scale are evident across multiple areas which help us drive growth and long-term shareholder value as further described below. Human Capital & Talent Our scale strengthens the Brands’ access to human capital resources and capabilities, which is essential to our Good Growth Strategy. Because they are part of the global citizenshipYUM system, our Brands are able to leverage talent exchanges from among the combined system’s large number of talented leaders who support the business and sustainability strategycreate value. This allows us to develop a strong bench to drive performance and move leaders and/or their experiences from one Brand to help another make similar progress and to foster improved results. The proponent’s view that each of our Brands could operate more effectively on their own does not fully comprehend these, and numerous other areas in which, efficiencies are created and innovation is supported by our current structure. Investments in Digital and Technology The Company’s combined structured allows for significantly greater investment in digital and technology initiatives than the executionBrands could each make on their own, which allow the Company and its Brands to become increasingly more competitive on both a domestic and international basis. Scale is becoming even more critical within the restaurant industry where technology and data capabilities will be a crucial competitive advantage relative to brands of existing goalssmaller scale. A key example of this can be seen in the Company’s acquisition of several technology-focused companies in recent years, which are allowing us to improve operations and commitmentsmaximize marketing efficiencies that would have been cost prohibitive for any Brand to undertake independently. An illustration of this is the acquisition of Dragontail in 2021. As of 2023, the Company has deployed Dragontail AI in nearly 7,000 restaurants across the Pizza Hut and KFC systems to help optimize delivery order sequencing and food preparation processes. The Company sees this acquisition as a vital step towards improving operations and digital capabilities throughout the global business and plans to roll out Dragontail AI in 6,000 new restaurants in 2024. Restaurants that implement Dragontail AI consistently see improvements in product quality and customer satisfaction scores as the order sequencing algorithm and driver dispatch capabilities enable us to deliver hot and fresh products to our customers. The cost of this acquisition would have represented 17% of Pizza Hut’s 2021 operating profit, making it and similar acquisitions, a significant financial endeavor from a singular Brand perspective. Because of the scale of YUM, Pizza Hut and its sister Brands will be able to receive the benefits of being part of a larger, unified system. Our Propriety Digital Systems In addition to the benefits provided by the Company’s increased acquisitive capabilities, the Brands also benefit from the investments the Company has, and continues to make, in its proprietary Ecommerce platform. The Brand benefit here is both in development and maintenance savings, as well as access to a platform which provides the Brands greater flexibility than third-party offerings would. Further, the Company’s digital offerings provide the most meaningful impact. YUM has a long history of focusing on the sustainability of its packaging as a key business initiative, evidenced by our shift to more sustainable materials, designing packaging to reduce wasteBrands and managing the impact of waste on communities and the planet. In July 2022, YUM took a significant step forward by publishing a new harmonized packaging policy, building upon Taco Bell and KFC’s existing packaging goals. The policy provides a single aspiration for all of our brands to work towards. The policy focuses on the following:

Eliminating Unnecessary Packaging

∎ | | Removing Styrofoam and Expanded Polystyrene (EPS) by 2022 across all brands.

|

∎ | | Eliminating unnecessary plastics by 2025 across all brands.

|

∎ | | Reducing virgin plastic content by 10% by 2025 across all brands.

|

Shifting Materials

∎ | | Procuring 100% of paper-based packaging with fiber from responsibly managed forests and recycled sources by the end of 2022 across all brands.

|

∎ | | Moving consumer-facing plastic packaging to be reusable, recyclable or compostable by 2025 across all brands.

|

∎ | | Removing added PFAS, Phthalates and BPA from packaging by 2025 across all brands.

|

Supporting Better Recovery & Recycling Systems

∎ | | Supporting expansion of recycling and composting programs, infrastructure systems and food recovery through strategic partnerships and advocacy.

|

∎ | | Diverting 50% of back-of-house operational waste, measured by weight, generated in U.S. restaurants by 2025.

|

∎ | | Reducing food loss and waste 50% by 2030 in U.S. restaurants in accordance with the U.S. Food Loss and Waste 2030 Champions goal.

|

31

| | | | | | | YUM! BRANDS, INC.

| | |  | | | 2023 PROXY STATEMENT

|

Investing in Circularity

∎ | | Expanding pilots across brands with focus on reusable packaging systems.

|

∎ | | Conducting assessments to better understand areas where more recycled content can be included to inform goal setting across all brands by 2023. Disclosure to show progress will begin in 2024.

|

∎ | | Testing and integrating more recoverable paper and paperboard packaging solutions.

|

YUM engaged with key stakeholders during the development of its new policy, including its brands, non-governmental organizations (NGOs), investors and regulators, to make sure it was comprehensive and inclusive of multiple perspectives given the complex nature of packaging opportunities at the local, national and global levels.

Some other key updates are listed below:

∎ | | In YUM’s most recent materiality assessment, “Packaging” was identified as one of the top material ESG topics for the Company. As such, Packaging continues to be a high priority area within our global citizenship and sustainability strategy, and one that is discussed at various levels within the organization including, but not limited to, the Board of Directors, YUM executive team, ESG Council, brand leadership teams and sustainability working groups.

|

∎ | | In 2018, YUM joined the NextGen Consortium, a multi-year consortium that addresses single-use food packaging waste globally by advancing the design, commercialization, and recovery of food packaging alternatives. YUM extended its support partnership of NextGen for another three years in 2021. As a supporting partner, YUM! continues to collaborate with other companies to help advance foodservice packaging solutions that are recoverable across global infrastructures, including exploring ways to design and commercialize reusable to-go cups.

|

∎ | | As stated in the packaging policy, YUM believes in taking a more circular approach when it comes to sustainable packaging and waste reduction. Reusable pilots in several markets will help YUM determine next steps in this area with the goal to expand further across the brands.

|

∎ | | In 2022, YUM was an active participant in the Global Plastics Treaty Dialogues, an activist-to-industry series of online summits focused on a global treaty for plastics convened by the Ocean Plastics Leadership Network (OPLN).

|

∎ | | Also in 2022, YUM become a sponsor of the Reuse Refill Action Forum, and sits on the advisory panel for the Food Service group. The Reuse and Refill Action Forum has representation across multiple sectors including industry, activism, finance, academia, government, and more, with the common goal of making productive progress on implementing and scaling reuse and refill systems.

|

∎ | | YUM also worked closely with World Wildlife Fund (WWF) to help elevate its data collection processes for plastics and packaging. YUM continues to disclose through its annual Global Citizenship and Sustainability Report and CDP (Climate, Forests and Water) reporting.

|

∎ | | Examples of progress in markets include:

|

| ∎ | | KFC Canada has replaced all plastic straws and bags with fiber-based alternatives and introduced a fully compostable bucket in 2021.

|

| ∎ | | Plastics in consumer-facing packaging have been eliminated from Pizza Hut restaurants across Taiwan and India.

|

| ∎ | | Taco Bell renewed its partnership with TerraCycle, an international recycling leader that collects the brand’s sauce packets and transforms them into new products.

|

| ∎ | | The Habit Burger Grill transitioned from plastic to-go bags to paper ones in 2022.

|

Additional information about YUM’s packaging and waste strategy and policy, can be found on YUM’s website at YUM.com/citizenship. The Board urges shareholders to vote AGAINST this proposal so that the Company may focus its efforts on accomplishing the strategy and goals described above, rather than using limited resources on issuing a report which is less likely to have a meaningful impact.

What Vote is Required to Approve this Proposal?

Approval of this proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting.

32

MATTERS REQUIRING SHAREHOLDER ACTION

What is the Recommendation of the Board of Directors?

Item 6 | Shareholder Proposal Regarding Issuance of Annual Report on Lobbying (Item 6 on the Proxy Card)

|

What am I Voting on?

The SOC Investment Group has advised us that it intends to present the following shareholder proposal at the Annual Meeting. We will furnish the address and share ownership of the proponent upon request. In accordance with federal securities regulations, we have included the text of the proposal and supporting statement exactly as submitted by the proponent. We are not responsible for the content of the proposal or any inaccuracies it may contain.

Whereas, we believe in full disclosure of lobbying activities and expenditures of YUM! Brands, Inc. (“YUM”) to assess whether YUM’s lobbying is consistent with its expressed goals and shareholders interests.

Resolved, YUM shareholders request the preparation of a report, updated annually, disclosing:

1. YUM’s policy and procedures governing its own lobbying, both direct and indirect, and grassroots lobbying communications.

2. Payments by YUM used for (a) direct or indirect lobbying or (b) grassroots lobbying communications, in each case including the amount of the payment and the recipient.

3. Description of management’s decision-making process and the Board’s oversight of this process.

For purposes of this proposal, a “grassroots lobbying communication” is a communication directed to the general public that (a) refers to specific legislation or regulation, (b) reflects a view on the legislation or regulation and (c) encourages the recipient of the communication to take action with respect to the legislation or regulation. “Indirect lobbying” is lobbying engaged in by a trade association or other organization of which YUM is a member.

Both “direct and indirect lobbying” and “grassroots lobbying communications” include efforts at the local, state and federal levels.

The report shall be presented to the Nominating and Corporate Governance Committee and posted on the YUM website.

Supporting Statement:

YUM does not currently report on the full extent of its lobbying efforts. We do know that YUM spent $12,610,746 from 2012-2022 on federal lobbying. The company also spent $100,000 almost exclusively to oppose AB 257 in 2022, a California law that creates a council to set minimum standards on working conditions, a law that industry groups now seek to overturn. Beyond that, there is not a complete picture of the company’s lobbying activities.

State level lobbying disclosures are uneven, incomplete or absent. For example, in Florida YUM spent anywhere between $1-$9,999 on lobbying for each of Q1-Q3 in 2022, a figure that does not provide investors with meaningful information. Additionally, from 2021-2022, YUM spent at least $90,000 on lobbying in New York State, and at least $64,000 on lobbying in New York City. Current disclosure systems require investors to search multiple databases, which may or may not hold complete data.

We are concerned that lack of disclosure could present reputational risk that could harm shareholder value from lobbying that is not alignedtheir franchisees with the Company’s public positions. YUM claimsopportunity to follow a “Recipe for Growth & Good” as the foundation for “sustainable, long-term results”. Complete reporting would shed light on how that commitment operates in practice.

33

| | | | | | | YUM! BRANDS, INC.

| | |  | | | 2023 PROXY STATEMENT

|

What isaccess emerging digital offerings at reduced costs and service levels exceeding those they could individually bargain for. For instance, the Company’s Position Regarding this Proposal?

Statementcustom-built SuperApp, which provides smart, automated routine management tools for our restaurant managers, is now used in Oppositionover 8,500 Pizza Hut restaurants, with KFC planning a roll out to Shareholder Proposal

Our Boardapproximately 6,000 restaurants in 2024. This type of Directors unanimously recommends that shareholders vote AGAINST this proposal, as it believes that the annual reports requested by the proposalforward-thinking investment would be largely duplicative of YUM’s existing reportingeconomically challenging for an independent Brand to create and is not an effective use of company resources.

The Company has a long history of industry-leading practices when it comes to lobbying disclosures that are grounded on its publicly available Political Contributions & Advocacy Policy. Key highlights include:

The Company is recognized as an industry leader in political contribution disclosure

∎ | | The CPA-Zicklin Index of Corporate Political Disclosure and Accountability ranks US public companies annually on transparency in political disclosures. As a result of the highly transparent nature of the YUM! Political Contributions and U.S. Government Advocacy Policy, the Company has been ranked by the CPA-Zicklin Index as either a “First Tier” or “Trendsetter” for its transparency in political contributions and advocacy for the past four years in a row, the two highest rankings that can be awarded to companies by the index.

|

The Company maintains a transparent and voluntary political contributions policy that goes beyond applicable regulatory requirements

∎ | | In addition to adhering to all federal, state, and local laws related to lobbying, the Company also provides more detailed voluntary disclosures, as outlined in the company’s Political Contributions and U.S. Government Advocacy Policy1. Under this policy, political contributions and advocacy expenditures are only made with the advance approval of the Company’s Chief Government Affairs Officer, with input from legal counsel when appropriate. Any approved political contribution in excess of $150 is voluntarily disclosed on the Company’s website, and all political contributions are reported to the Nominating and Governance Committee of the Company’s Board of Directors on an annual basis.

|

∎ | | Additionally, the Company discloses on its website any non-deductible payments for political purposes to trade associations that received at least $50,000 from YUM during the calendar year. Those non-deductible amounts and trade association contributions are also reported to the Nominating and Governance Committee of the Company’s Board of Directors on an annual basis.

|

Company political contributions are well-regulated under federal, state, and local law

∎ | | The Company already submits quarterly and semi-annual reports of its federal advocacy efforts as required by the U.S. Lobbying Disclosure Act. Additionally, Federal Election Commission (“FEC”) regulations require the Company’s YUM Good Government Fund Political Action Committee (“PAC”) to file periodic reports detailing the source of the funds it receives and how they were expended, all of which are readily available for public inspection at www.fec.gov. Where permitted by state law, the PAC also contributes to state candidates and files timely disclosure reports as required by each state’s laws.

|

In summary, the Board views the additional disclosures requested by the proposal as unnecessary and duplicative. The Company already adheres to all federal, state, and local regulations governing the disclosure of political activities, and the company’s own voluntary policy provides even greater transparency that has been consistently recognized as industry-leading by the CPA-Zicklin Index. As such, our existing policies sufficiently address the concerns raised in this proposal and, accordingly, the Board recommends that shareholders vote AGAINST this proposal.

1 YUM! Political Contributions and U.S. Government Advocacy Policy

2https://www.politicalaccountability.net/cpa-zicklin-index/past-cpa-zicklin-index-reports/support.

34

MATTERS REQUIRING SHAREHOLDER ACTION Information Technology Support Services and Global Technology Risk Management Our Brands also rely on the Company for cost effective and secure Information Technology Support Services and Global Technology Risk Management, which are pivotal in the protection of assets and customer data, an increasingly important area of focus for all companies. The Company’s support services in these areas are numerous and extend far beyond the digital and technology systems referred to above. Consumer Insights In addition, the Brands leverage the Company’s cross-brand and cross-market customer data. The Brands utilize the Company’s unique global scale to bring new insights and enable even smarter and quicker decision-making. This year, the Company expanded its global data hub, which captures a significant and growing portion of global transaction-level sales data and other key operational and customer metrics. Brands are given unprecedented visibility into the ordering behaviors of millions of customers across the other Brands. In addition, the Brands have access to breakthrough consumer insight from Collider, the Company’s boutique insights consultancy. Best-in-Class Franchisees Our Brands also have access to best-in-class franchisees. As of 2024, 80% of our global development was driven by 15 publicly traded franchisees, many of which are franchisees of more than one of our Brands. Our capable, well capitalized and committed franchisee partners know we offer unmatched scale that we leverage through supply chain excellence and favorable vendor terms, including cutting-edge aggregator agreements. Further, through our scale we offer a nearly unlimited range of growth opportunities through things like category restaurant design, flexible format options and leading market mapping capabilities culminating in compelling and consistent new unit returns. Finally, the Company’s Brands are able to leverage our extensive international franchise relationships and go-to market strategies designed to provide them with accelerated development opportunities in new and evolving markets. The scope of these capabilities would be meaningfully reduced for the Brands operating in isolation. Our Board of Directors unanimously recommends that shareholders vote AGAINST this proposal, for the reasons set forth above, as it would divert time and resources that the Company has determined would be better used to support our strategic business objectives. What Vote is Required to Approve this Proposal? Approval of this proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting. What is the Recommendation of the Board of Directors?

Item 7 | Shareholder Proposal Regarding Issuance of Civil Rights and Nondiscrimination Audit Report (Item 7 on the Proxy Card)

|

What am I Voting on?

The National Center for Public Policy Research has advised us that it intends to present the following shareholder proposal at the Annual Meeting. We will furnish the address and share ownership of the proponent upon request. In accordance with federal securities regulations, we have included the text of the proposal and supporting statement exactly as submitted by the proponent. We are not responsible for the content of the proposal or any inaccuracies it may contain.

Resolved: Shareholders of the Company request that the Board of Directors commission an audit analyzing the Company’s impacts on civil rights and non-discrimination, and the impacts of those issues on the Company’s business. The audit may, in the Board’s discretion, be conducted by an independent and unbiased third party with input from civil rights organizations, public-interest litigation groups, employees and other stakeholders - of a wide spectrum of viewpoints and perspectives. A report on the audit, prepared at reasonable cost and omitting confidential or proprietary information, should be publicly disclosed on the Company’s website.

Supporting Statement:

Tremendous public attention has focused recently on workplace and employment practices. All agree that employee success should be fostered and that no employees should face discrimination, but there is much disagreement about what non-discrimination means.

Concern stretches across the ideological spectrum. Some have pressured companies to adopt “Diversity, Equity & Inclusion” (DEI) programs that seek to establish “racial/social equity,” which appears to mean the distribution of pay and authority on the basis of race, sex, orientation and ethnic categories rather than by merit.1 Where adopted, such programs raise significant objection, including concern that DEI programs are themselves deeply racist, sexist and otherwise discriminatory.2

Many companies have been found to be sponsoring and promoting overtly and implicitly discriminatory employee-training and other employment and advancement programs, including Bank of America, American Express, Verizon, Pfizer, CVS, and YUM! Brands itself.3

This disagreement and controversy create massive reputational, legal and financial risk. If the Company is, in the name of equity, diversity and inclusion, committing illegal or unconscionable discrimination against employees deemed “non-diverse,” then the Company will suffer in myriad ways- all of them both unforgivable and avoidable.

In developing the audit and report, the Company should consult civil-rights and public-interest law groups but it must not compound error with bias by relying only on left-leaning organizations. Rather, it must consult groups across the spectrum of

35

| | | | | | | | | YUM! BRANDS, INC. | | |  | | | 20232024 PROXY STATEMENT

|

viewpoints. This includes right-leaning civil-rights groups representing people of color, such as the Woodson Center4 and Project 21,5 and groups that defend the rights and liberties of all Americans, not merely the ones that many companies label “diverse.” All Americans have civil rights; to behave otherwise is to invite disaster.

Similarly, when including employees in its audit, the Company must allow employees to speak freely without fear of reprisal or disfavor, and in confidential ways. Too many employers have established company stances that themselves chill contributions from employees who disagree with the company’s asserted positions, and then have pretended that the employees who have been empowered by the companies’ partisan positioning represent the true and only voice of all employees. This by itself creates a deeply hostile workplace for some groups of employees, and is both immoral and likely illegal.

1 https://www.sec.gov/Archives/edgar/data/1048911/000120677421002182/fdx3894361defl4a.htm#StockholderProposals8 8; https://www.sec.gov/divisions/corpfin/cf-noaction/I4a8/2021/asyousownike051421-14a8-incoming.pdf; https://www.sec.gov/divisions/corpfin/cf-noaction/ I4a8/2021/nyscrfamazon0 12521-14a8-incoming.pdf; https://www.sec.gov/Archives/edgar/data/1666700/000119312521079533/dI08785ddefl4a.htm#rom10878558

2 https://www.americanexperiment.org/survey-says-americans-oppose-critical-race-theory/; https://www.newsweek.com/majority-americans-hold-negative-view-critical-race-theory-amid-controversy1601337; https://www.newsweek.com/coca-cola-facing-backlash-says-less-white-learning-plan-was-aboutworkplace-inclusion-1570875;https://nypost.corn/2021/08/11/american-express-tells-its-workers-capitalism-is-racist/;https://www.city-journal.org/verizon-critical-race-theory-training

3 https://www.city-journal.org/bank-of-america-racial-reeducation-program; https://www.city-journal.org/verizoncritical- race-theory-training; https://nypost.com/2021/08/11/american-express-tells-its-workers-capitalism-is-racist; https://www.foxbusiness.com/politics/cvs-inclusion-training-critical-race-theory; https://www.msn.com/enus/money/other/pfizer-sets-race-based-hiring-goals-in-the-name-of-fighting-systemic-racism-gender-equitychallenges/ar-AAOiSwJ;https://www.thecollegefix.com/federal-investigation-launched-into-mba-program-that-excludes-white-males/

4 https://woodsoncenter.org/

5https://nationalcenter.org/project-21/

What is the Company’s Position Regarding this Proposal?

Statement in Opposition to Shareholder Proposal

Our Board of Directors unanimously recommends that shareholders vote AGAINST this proposal, as it would divert time and resources that the Company has determined would be better used to support our human capital management strategy, which includes the advancement of strategic workplace and employment practices related to the implementation of our equity, inclusion and belonging initiatives, in a way that is consistent with the Company’s values and its mission to make room for all people and voices at our tables, as well as applicable law. The Company is confident that its approach will be beneficial to all stakeholders and that its efforts have not created the “overtly and implicitly discriminatory employee-training and other employment and advancement programs” that the proponent suggests may exist. In fact, the Company has taken great steps towards efforts to make the Company an employer of choice for people from all backgrounds.

YUM is focused on making room for all people and voices at our tables by taking bigger and bolder steps to ensure that we reflect the customers and communities we serve in every corner of our business. The board and management believe that this will ultimately fuel long-term growth and help build brands that people trust and champion. At YUM, our first priority is our people. To this end, the Company’s overarching principles dealing with the creation of a welcoming environment to all employees is codified in the YUM! Global Code of Conduct (“Code”). The Code, which was adopted by our Board of Directors, provides that “YUM, and its subsidiaries, are committed to ensuring our employees are treated with respect and dignity which includes a workplace that is free from discrimination, harassment, bullying, illegal substances and unsafe conditions. The Code further makes clear that the Company “recruits, hires, compensates, develops, promotes, disciplines and terminates individuals based upon merit and without regard to a person’s race, color, creed, religion, sex (including pregnancy, childbirth, and medical conditions related to pregnancy, childbirth and breastfeeding), age, mental or physical disability, protected medical condition, physical impairment, genetic information, sexual orientation, gender, gender identity, gender expression, sex stereotyping, national origin, ancestry, nationality, social or ethnic origin, military or veteran status, marital status, citizenship status, political affiliation, or other legally protected status. The Company is confident that its efforts to create a more inclusive workplace for all people are designed in a way that is entirely consistent with the ideals set forth in the Code.

36

MATTERS REQUIRING SHAREHOLDER ACTION

Day-to-day oversight for equity, inclusion and belonging starts with our Global Leadership Team and is managed by our global Equity, Inclusion & Belonging team, led by YUM Brands’ Chief Equity & Inclusion Officer. Building on our ongoing efforts and starting from the inside out, YUM is strengthening and implementing plans for our corporate offices and company-owned restaurants with a focus on:

∎ | | Creating more diverse representation among our executive and management ranks, including elevating women into leadership to achieve gender parity globally by 2030, in alignment with our partner Paradigm for Parity;

|

∎ | | In the U.S., increasing underrepresented people of color and gender diversity including Black, Hispanic/Latino, Asian-American, women and LGBTQ+ leaders and employees; and

|

∎ | | Expanding the multicultural competency of our existing corporate workforce through increased access to global “Inclusive Leadership” experiences, individual equity and inclusion commitments and engagement in our employee resource groups (ERGs).

|

Further, the Company is committed to accomplishing these goals in a transparent manner, highlighted by its continued disclosure initiatives in this space. Since 2019, the Company has publicly disclosed a detailed Workforce Diversity Report and, more recently, has taken the additional step of making its Form EE0-1 disclosure public. The Company acknowledges the importance of transparency in related disclosures and expects to continue making accurate reports of progress against these goals.

The Board unanimously recommends that shareholders vote AGAINST this proposal, as it would divert time and resources that the Company has determined would be better used to support our human capital management strategy, including efforts focused on the implementation of our equity, inclusion and belonging initiatives. As set forth above, the Company is confident that the implementation of this strategy has been done in a way that is consistent with the Company’s values and its mission to make room for all people and voices at our tables.

What Vote is Required to Approve this Proposal?

Approval of this proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting.

What is the Recommendation of the Board of Directors?

Item 8 | Shareholder Proposal Regarding Disclosure of Share Retention Policies for Named Executive Officers Through Normal Retirement Age (Item 8 on the Proxy Card)

|

What am I Voting on?

The New York State Common Retirement Fund has advised us that it intends to present the following shareholder proposal at the Annual Meeting. We will furnish the address and share ownership of the proponent upon request. In accordance with

37

| | | | | | | YUM! BRANDS, INC.

| | |  | | | 2023 PROXY STATEMENT

|

federal securities regulations, we have included the text of the proposal and supporting statement exactly as submitted by the proponent. We are not responsible for the content of the proposal or any inaccuracies it may contain.

RESOLVED: Shareholders of YUM! Brands, Inc. (“Company”) urge the Compensation Committee of the Board of Directors (“Committee”) to disclose if, and how, it seeks to require that named executive officers retain a significant percentage of shares acquired through equity compensation programs until reaching normal retirement age.

In its discretion, the Committee may wish to consider:

| ∎ | | Defining normal retirement age based on the Company’s qualified retirement plan with the largest number of participants,

|

| ∎ | | Adopting a share holding period requirement of at least one year after they retire or separate from the Company,1 and

|

| ∎ | | Whether this supplements any other share ownership requirements that have been established for senior executives.

|

This policy should be implemented so as not to violate the Company’s existing contractual obligations or the terms of any compensation or benefit plan currently in effect.

Supporting Statement:

Equity-based compensation is an important component of senior executive compensation at our Company. While we encourage the use of equity-based compensation for senior executives, we are concerned that our Company’s senior executives generally do not have to hold shares received from equity compensation plans after meeting targets.

We are especially concerned that in 2022 significantly more of the Company’s shareholders voted to oppose the compensation of the Companies’ named executive officers (“say-on-pay” vote) than the year before.

Our proposal seeks to better link executive compensation with long-term performance by requiring meaningful retention of shares senior executives receive from the Company’s equity compensation plans. Requiring named executives to hold a significant percentage of shares obtained through equity compensation plans until they reach retirement age, regardless of when the executive retires, will better align the interests of executives with the interests of shareholders and the Company.

In our opinion, the Company’s current share ownership guidelines for senior executives do not go far enough to ensure that the Company’s equity compensation plans continue to build stock ownership by senior executives over the long term. We believe that requiring senior executives to only hold shares equal to a set target loses effectiveness over time. After satisfying these target holding requirements, senior executives do not have to hold the additional shares they receive in equity compensation. We believe that requiring executives to retain a portion of all annual stock awards provides incentives to avoid short-term thinking and to promote long-term, sustainable value.

1 https://www.cii.org/files/ciicorporategovernancepolicies/20190918NewExecCompPolicies.pdf

What is the Company’s Position Regarding this Proposal?

Statement in Opposition to Shareholder Proposal

Our Board of Directors unanimously recommends that shareholders vote AGAINST this proposal, as it is not needed on account of the effectiveness of our current ownership requirements for executives and it would not provide any additional benefit to our shareholders and could negatively impact our ability to attract and retain the best talent available.

The Board’s Management Planning and Development Committee (“Committee”) has established stock ownership guidelines for approximately 210 of our senior employees, including our executive leadership. If a covered executive does not meet his or her ownership guidelines, he or she is not eligible for a long-term equity incentive award. In 2022, all executive officers subject to guidelines met or exceeded their ownership guidelines.

Requiring that our executive officers retain a “significant percentage” of shares acquired through equity compensation programs until reaching normal retirement age would place unnecessary restrictions on the Committee’s ability to design a

38

MATTERS REQUIRING SHAREHOLDER ACTION

compensation program that drives long-term value for the company by retaining and recruiting world class talent. In addition, such a requirement would create an unnecessary burden for our executives that is not well designed to best serve the aims of our compensation program’s goals. Our executive compensation program implements long-term vesting and performance periods (featuring objective performance measures) that are designed to drive Company performance and long term shareholder value. This design, coupled with our current ownership requirements, is most appropriate to align shareholder and executive interests over the long term.

A significant portion of our executive officers’ total compensation is performance-based and paid in a mix of an annual cash bonus and long-term incentive equity awards, which are made up of performance share units, stock appreciation rights and restricted stock units. These awards vest over three- (PSUs) and four- (SARs and RSUs) year periods from the date of grant. The Committee believes that focusing on performance-based compensation and long-term incentive awards is the best way to properly incentivize and motivate our executives to build long-term shareholder value. The Board is confident that our current compensation program design is best positioned to align our executive compensation to long-term shareholder returns and that requiring executives to hold a significant number of Company shares until retirement – without consideration of the value of their existing stock ownership – would not provide any benefit to shareholders and would be unnecessarily burdensome to our executives. In addition, the proposed policy is not consistent with current market practices among our peers and the Board is concerned that if this policy were implemented it could negatively affect our ability to retain and recruit highly talented executives.

The Board believes that our current stock ownership guidelines are effective in aligning executive and shareholder interests, as our executive officers are already required to hold significant amounts of our shares and in longer-tenured roles, greatly exceed those requirements. YUM’s current policy requires that our executive officers hold shares of our common stock at least equal to a multiple of their base salary as follows:

∎ | | Chief Executive Officer – seven times

|

∎ | | Chief Financial Officer and Chief Operating Officer & Chief People Officer – three times

|

∎ | | Other Named Executive Officers – three times

|

See the section titled “Executive Stock Ownership Guidelines” on page 66 for more information.

In addition, under our Code of Conduct, no employee or director is permitted to engage in securities transactions that would allow them either to insulate themselves from, or profit from, a decline in the Company stock price. Similarly, no employee or director may enter into hedging transactions in the Company’s stock. Under YUM’s policies, such transactions include (without limitation) short sales as well as any hedging transactions in derivative securities (e.g. puts, calls, swaps, or collars) or other speculative transactions related to YUM’s stock. Pledging of Company stock is also prohibited.

Our Board of Directors believes that our executive compensation program, including our stock ownership guidelines and other related policies, effectively create alignment of the interests of our executive officers and the creation of long-term value for shareholders, and, as result the actions called for under this proposal are not beneficial or necessary.

What Vote is Required to Approve this Proposal?

Approval of this proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting.

What is the Recommendation of the Board of Directors?

39

| | | | | | | YUM! BRANDS, INC.

| | |  | | | 2023 PROXY STATEMENT

|

Item 9 | Shareholder Proposal Regarding Issuance of Report on Paid Sick Leave (Item 9 on the Proxy Card)

|

What am I Voting on?

United Church Funds has advised us that it intends to present the following shareholder proposal at the Annual Meeting. We will furnish the address and share ownership of the proponent upon request. In accordance with federal securities regulations, we have included the text of the proposal and supporting statement exactly as submitted by the proponent. We are not responsible for the content of the proposal or any inaccuracies it may contain.

WHEREAS: Nearly 28 million people working in the private sector in the U.S. have no access to earned sick time, or “paid sick leave” (PSL), for short-term health needs and preventive care.1 Working people in the United States face an impossible choice when they are sick: to stay home and risk their economic stability, or to go to work and risk their health and the public’s health.

The vast majority (62%) of the lowest earning 10% of American employees do not have access to PSL.2 48% of Latinx workers and 36% of Black workers report having no paid time away from work of any kind.3

As the COVID-19 pandemic has shown, PSL is a crucial contributor to improved public health outcomes, allowing workers exposed to illness to quarantine. One study found a 56% reduction in COVID-19 cases per state as a result of temporary federally mandated PSL,4 and others an 11-30% reduction in influenza-like illnesses from state and local mandates.5 State and local PSL mandates have been shown to reduce the rate at which employees report to work ill in low-wage industries where employers don’t tend to provide PSL, lowering disease and absence rates.6

PSL increases productivity7 and reduces turnover, which reduces hiring costs.8 This is important for lower-wage industries with high turnover. Companies across sectors, such Darden,9 Facebook,10 Home Depot, Levi’s,11 and Patagonia12 are expanding and disclosing their policies to benefit their employees and bolster their brands.13

YUM! Brands discloses that it provides 4 Weeks Vacation + Holidays.14 However, it does not publicly describe its paid sick leave policy, aside from noting the company is “expanding paid sick time” in the 2021 sustainability report.15

It is not clear if there are any PSL provisions at YUM! Brands to protect franchise employees. YUM has 53,000 restaurants (KFC, Taco Bell, Pizza Hut, Habit Burger) in 157 countries and reports that 98% of these stores are franchised.16

More transparency on the company’s policies, such as worker eligibility requirements, hours of PSL provided by worker classification, requirements for using PSL, applicability to workers of company-owned versus franchise locations, and whether PSL can be used to care for a family member who is ill, will help investors understand how the company manages this human capital management, brand maintenance, and public health issue.

Increasing transparency of YUM! Brands’ paid sick leave policy would help the company demonstrate how it is implementing its commitment to “providing safe and healthy work environments for all employees.”17

RESOLVED: Shareholders of YUM! Brands ask the company to issue a report analyzing the provision of paid sick leave among franchise employees and assessing the feasibility of inducing or incentivizing franchisees to provide some amount of paid sick leave to all employees.

1 https://www.bls.gov/news.release/pdf/ebs2.pdf

2 https://www.bls.gov/news.release/pdf/ebs2.pdf

3 https://www.bls.gov/news.release/leave.t01.htm

4 https://www.healthaffairs.org/doi/10.1377/hlthaff.2020.00863

5 https://www.nber.org/system/files/working_papers/w26832/w26832.pdf

40

MATTERS REQUIRING SHAREHOLDER ACTION

6https://voxeu.org/article/pros-and-cons-sick-pay

7https://voxeu.org/article/pros-and-cons-sick-pay

8 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5649342/

9 https://www.darden.com/careers/restaurant-careers

10 https://techcrunch.com/2017/02/07/facebook-parental-leave-bereavement-benefits/

11https://hrexecutive.com/levis-to-offer-paid-sick-leave-to-part-time-workers/

12https://www.patagonia.com/stories/family-business-weighing-the-business-case/story-32958.html

13 https://techcrunch.com/2017/02/07/facebook-parental-leave-bereavement-benefits/

14 https://www.yum.com/wps/portal/yumbrands/yumbrands/careers

15https://www.yum.com/wps/wcm/connect/yumbrands/5c5d560b-8d77-4ea2-bdc0-bc9f595bdc2c/R4G-Report- 2021.pdf?MOD=AJPERES&CVID=o9EO5zQ

16 https://s2.q4cdn.com/890585342/files/doc_financials/2021/ar/2021-annual-report.pdf

17https://s2.q4cdn.com/890585342/files/doc_governance/2022/06/Code-of-Conduct-English.pdf

Supporting Statement:

The report may include an assessment of potential avenues for the company to influence franchisees to take the requested action(s) on paid sick leave, such as financial incentives, franchise agreements, or other means.

What is the Company’s Position Regarding this Proposal?

Statement in Opposition to Shareholder Proposal

Our Board of Directors unanimously recommends that shareholders vote AGAINST this proposal, as it would divert time and resources that the Company has determined would be better used to support our total rewards strategy for our employees. In addition, the proposal seeks for the Company to collect information about the employees of its franchisees, who independently own and operate their businesses, and for which the Company does not have consistent or complete access to franchise employment data. Our franchisees are independently responsible for the employment relationship with their employees and the Company is not involved in these matters.

For its own workforce, the Company does devote significant time and attention to attract, develop and retain the most capable talent available to drive performance and create long-term shareholder value. Part of these efforts are based on our developing a total rewards compensation package for all employees that is competitive with market practice. In addition to providing competitive offerings from a total rewards perspective, the Company also seeks to attract and retain the best talent by offering employees an inclusive workplace, with programs that support our diverse group of employees and help provide them with careers that are rewarding financially and fulfilling personally. Our Board and executive management play a leading role in overseeing our overarching human capital strategy, which includes total rewards, equity, inclusion and belonging, career development, and employee health and safety.

The emphasis placed on our total rewards program demonstrates how important our talent is to the Company’s success. Given this elevated level of importance, the Company seeks to offer competitive wages and benefits which are designed to meet our employees’ expectations and needs. Some of our benefit programs include annual bonuses, 401(k) plan, stock awards, health insurance benefits, paid time off, flexible or hybrid work schedules, family leave, parental leave, dependent care programs, employee assistance programs, tuition assistance and scholarships, depending on eligibility.

During the COVID-19 pandemic, we began providing enhanced benefits to employees, including our Company-owned restaurant employees. These enhanced benefits included paid sick leave for all employees, including part-time employees, without a minimum hours requirement. This paid sick leave benefit remains in place today. Every Company employee currently has access to at least three days of paid sick leave beginning on the first day of employment. This amount is greater in jurisdictions which require a greater minimum number of paid sick leave days to be provided. This benefit is available regardless of an employee’s scheduled hours and may be used if the employee is sick, or if they need to care for a family member in their household who is ill.

41

| | | | | | | YUM! BRANDS, INC.

| | |  | | | 2023 PROXY STATEMENT

|

In addition, our employees have access to various medical plan options through UMR (a subsidiary of United Healthcare). Under the UMR plans, employees and their covered dependents have access to differing suites of benefits based on their individual preferences.

The shareholder proposal seeks to have the Company provide a report regarding the provision of paid sick leave benefits by its franchisees. As mentioned above, our 1,500 franchisees independently own and operate their restaurants and are responsible for the entirety of the employment relationship with their employees. Many of our franchisees are themselves large corporations that have their own human resources departments that are developing total rewards strategies to attract and retain top talent. Like YUM, our franchisees are incentivized to offer competitive total rewards programs so that they may compete effectively for talent in geographies within which they operate. YUM does not interfere with the employment practices of our franchisees or otherwise micromanage their benefits offerings. As a result, YUM does not have readily available access to data regarding the specific paid sick leave policies of each of its franchisees. This would make collecting the data requested by the proponent both costly and time consuming, without providing a real benefit to our employees, franchisee employees or shareholders.

Further, preparing a report on how the Company could induce or incentivize franchisees to adopt a particular paid sick leave policy would require the expenditure of considerable time and money and would not be beneficial, as this ignores the fact that our franchisees are solely responsible for the employment relationship with their employees and that they are already appropriately incentivized to provide competitive benefits packages, as they need to do so in order to ensure the success of their own businesses.

In summary, the proposal would divert time and resources that the Board has determined would be better used to support our business, including its total rewards strategy.

What Vote is Required to Approve this Proposal?

Approval of this proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting.

What is the Recommendation of the Board of Directors?

42

STOCK OWNERSHIP INFORMATION

STOCK OWNERSHIP INFORMATION Who are Our Largest Shareholders? This table shows ownership information for each YUM shareholder known to us to be the owner of 5% or more of YUM common stock. This information is presented as of December 31, 20222023 and is based on a stock ownership report on Schedule 13G filed by such shareholders with the SEC and provided to us. | Name and Address of Beneficial Owner | | Number of Shares Beneficially Owned | | | Percent of Class | | | Number of Shares

Beneficially Owned | | | Percent

of Class | | | The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | | | 22,707,954 | (1) | | | 8.06 | % | The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | | The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | | The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | | | | 23,397,919 | (1) | | | 8.35 | % | | Blackrock Inc. 55 55 East 52nd Street New York, NY 10055 | | | 20,897,445 | (2) | | | 7.4 | % | Blackrock Inc. 55 55 East 52nd Street New York, NY 10055 | | Blackrock Inc. 55 55 East 52nd Street New York, NY 10055 | | Blackrock Inc. 55 55 East 52nd Street New York, NY 10055 | | Blackrock Inc. 55 55 East 52nd Street New York, NY 10055 | | | | 23,329,589 | (2) | | | 8.3 | % | | T. Rowe Price Investment Management, Inc. 101 E. Pratt Street Baltimore MD 21201 Malvern, PA 19355 | | T. Rowe Price Investment Management, Inc. 101 E. Pratt Street Baltimore MD 21201 Malvern, PA 19355 | | T. Rowe Price Investment Management, Inc. 101 E. Pratt Street Baltimore MD 21201 Malvern, PA 19355 | | T. Rowe Price Investment Management, Inc. 101 E. Pratt Street Baltimore MD 21201 Malvern, PA 19355 | | | | 15,939,260 | (3) | | | 5.70 | % | | Capital World Investors 333 South Hope Street, 55th Floor Los Angeles CA 90071 | | Capital World Investors 333 South Hope Street, 55th Floor Los Angeles CA 90071 | | Capital World Investors 333 South Hope Street, 55th Floor Los Angeles CA 90071 | | Capital World Investors 333 South Hope Street, 55th Floor Los Angeles CA 90071 | | | | 14,785,763 | (4) | | | 5.3 | % | | Capital International Investors 333 South Hope Street, 55th Floor Los Angeles CA 90071 | | Capital International Investors 333 South Hope Street, 55th Floor Los Angeles CA 90071 | | Capital International Investors 333 South Hope Street, 55th Floor Los Angeles CA 90071 | | Capital International Investors 333 South Hope Street, 55th Floor Los Angeles CA 90071 | | | | 14,081,926 | (5) | | | 5.00 | % |

(1) The filing indicates sole voting power for 0 shares, shared voting power for 394,636369,410 shares, sole dispositive power of 21,550,861shares22,197,371 shares and shared dispositive power for 1,157,0931,200,548 shares. (2) The filing indicates sole voting power for 18,351,00020,696,867 shares, shared voting power for 0 shares, sole dispositive power for 20,897,44523,329,589 shares and shared dispositive power for 0 shares. (3) The filing indicates sole voting power for 4,869,432 shares, shared voting power for 0 shares, sole dispositive power for 15,939,260 shares and shared dispositive power for 0 shares. (4) The filing indicates sole voting power for 14,674,848 shares, shared voting power for 0 shares, sole dispositive power for 14,785,763 shares and shared dispositive power for 0 shares. (5) The filing indicates sole voting power for 13,927,882 shares, shared voting power for 0 shares, sole dispositive power for 14,081,926 shares and shared dispositive power for 0 shares How Much YUM Common Stock is Owned by Our Directors and Executive Officers? This table shows the beneficial ownership of YUM common stock as of December 31, 20222023 by | ∎ | | each of the executive officers named in the Summary Compensation Table on page 68,59, and |

| ∎ | | all directors and relevant executive officers as a group. |

Unless we note otherwise, each of the following persons and their family members have sole voting and investment power with respect to the shares of common stock beneficially owned by him or her. None of the persons in this table (nor the Directors and executive officers as a group) holds in excess of one percent of the outstanding YUM common stock. Please see the table above setting forth information concerning beneficial ownership by holders of five percent or more of YUM’s common stock. 4336

| | | | | | | YUM! BRANDS, INC.STOCK OWNERSHIP INFORMATION

| | |  | | | 2023 PROXY STATEMENT

|

The table shows the number of shares of common stock and common stock equivalents beneficially owned as of December 31, 2022.2023. Included are shares that could have been acquired within 60 days of December 31, 20222023 through the exercise of stock options, stock appreciation rights (“SARs”) or distributions from the Company’s deferred compensation plans, together with additional underlying stock units as described in footnote (4) to the table. Under SEC rules, beneficial ownership includes any shares as to which the individual has either sole or shared voting power or investment power and also any shares that the individual has the right to acquire within 60 days through the exercise of any stock option or other right. | | | | Beneficial Ownership | | | | | | | | | Beneficial Ownership | | | | | | | | Name | | Number of Shares Beneficially Owned(1) | | | Options/ SARs Exercisable within 60 Days(2) | | | Deferral Plans Stock Units(3) | | | Total Beneficial Ownership | | | Additional Underlying Stock Units(4) | | | Total | | | Number

of Shares

Beneficially

Owned(1) | | | Options/

SARs

Exercisable

within

60 Days(2) | | | Deferral

Plans Stock Units(3) | | | Total

Beneficial

Ownership | | | Additional

Underlying

Stock

Units(4) | | | Total | | | Paget Alves | | | 6,309 | | | | – | | | | – | | | | 6,309 | | | | 10,796 | | | | 17,105 | | Paget Alves | | Paget Alves | | Paget Alves | | | | 6,309 | | | | – | | | | – | | | | 6,309 | | | | 13,156 | | | | 19,465 | | | Keith Barr | | | – | | | | – | | | | – | | | | – | | | | 6,777 | | | | 6,777 | | Keith Barr | | Keith Barr | | Keith Barr | | | | – | | | | – | | | | – | | | | – | | | | 8,909 | | | | 8,909 | | | Brett Biggs | | Brett Biggs | | Brett Biggs | | Brett Biggs | | | | – | | | | – | | | | – | | | | – | | | | 533 | | | | 533 | | | Christopher Connor | | Christopher Connor | | Christopher Connor | | Christopher Connor | | | – | | | | – | | | | – | | | | – | | | | 15,508 | | | | 15,508 | | | | – | | | | – | | | | – | | | | – | | | | 17,792 | | | | 17,792 | | | Brian C. Cornell | | | 452 | | | | 1,981 | | | | – | | | | 2,433 | | | | 27,533 | | | | 29,966 | | Brian C. Cornell | | Brian C. Cornell | | Brian C. Cornell | | | | 452 | | | | 2,002 | | | | – | | | | 2,454 | | | | 30,959 | | | | 33,413 | | | Tanya Domier(5) | | | 4,957 | | | | – | | | | – | | | | 4,957 | | | | 10,264 | | | | 15,221 | | Tanya Domier | | Tanya Domier | | Tanya Domier | | Tanya Domier | | | | 4,957 | | | | – | | | | – | | | | 4,957 | | | | 12,396 | | | | 17,353 | | | Susan Doniz | | Susan Doniz | | Susan Doniz | | Susan Doniz | | | | – | | | | – | | | | – | | | | – | | | | 533 | | | | 533 | | | Mirian M. Graddick-Weir | | Mirian M. Graddick-Weir | | Mirian M. Graddick-Weir | | Mirian M. Graddick-Weir | | | 1,233 | | | | 4,451 | | | | – | | | | 5,684 | | | | 34,774 | | | | 40,458 | | | | 1,233 | | | | 3,187 | | | | – | | | | 4,420 | | | | 37,058 | | | | 41,478 | | | Thomas C. Nelson | | | 18,612 | | | | 4,451 | | | | – | | | | 23,063 | | | | 72,631 | | | | 95,694 | | Thomas C. Nelson | | Thomas C. Nelson | | Thomas C. Nelson | | | | 19,926 | | | | 3,187 | | | | – | | | | 23,113 | | | | 74,763 | | | | 97,876 | | | Justin Skala | | Justin Skala | | Justin Skala | | Justin Skala | | | 11,280 | | | | 1,424 | | | | – | | | | 12,704 | | | | 7,932 | | | | 20,636 | | | | 13,795 | | | | 1,439 | | | | – | | | | 15,234 | | | | 7,549 | | | | 22,783 | | | Annie Young-Scrivner | | | 4,171 | | | | – | | | | – | | | | 4,171 | | | | 2,636 | | | | 6,807 | | Annie Young-Scrivner | | Annie Young-Scrivner | | Annie Young-Scrivner | | | | 4,171 | | | | – | | | | – | | | | 4,171 | | | | 4,768 | | | | 8,939 | | | David Gibbs(5) | | | 97,608 | | | | 296,052 | | | | 49,166 | | | | 442,826 | | | | 86,057 | | | | 528,883 | | David Gibbs | | David Gibbs | | David Gibbs | | David Gibbs | | | | 123,218 | | | | 290,989 | | | | 10,287 | | | | 424,494 | | | | 7,786 | | | | 432,280 | | | Christopher Turner | | | 8,883 | | | | 13,559 | | | | 11,582 | | | | 34,024 | | | | 3,916 | | | | 37,940 | | Christopher Turner | | Christopher Turner | | Christopher Turner | | | | 16,785 | | | | 20,624 | | | | 0 | | | | 37,409 | | | | 0 | | | | 37,409 | | | Tracy Skeans(5) | | | 20,682 | | | | 66,388 | | | | 10,594 | | | | 97,664 | | | | 11,182 | | | | 108,846 | | Tracy Skeans | | Tracy Skeans | | Tracy Skeans | | Tracy Skeans | | | | 13,418 | | | | 74,758 | | | | 851 | | | | 89,027 | | | | 1,824 | | | | 90,851 | | | Mark King | | | 11,759 | | | | 10,296 | | | | 8,621 | | | | 30,676 | | | | 2,741 | | | | 33,417 | | Sabir Sami | | Sabir Sami | | Sabir Sami | | Sabir Sami | | | | 6,652 | | | | 61,016 | | | | 0 | | | | 67,668 | | | | 0 | | | | 67,668 | | | Aaron Powell | | | 4,933 | | | | 234 | | | | 1,043 | | | | 6,210 | | | | 19,475 | | | | 25,685 | | Aaron Powell | | Aaron Powell | | Aaron Powell | | | | 10,721 | | | | 620 | | | | 0 | | | | 11,341 | | | | 0 | | | | 11,341 | | | All Directors and Executive Officers as a Group (17 persons) | | | 221,758 | | | | 554,723 | | | | 89,840 | | | | 866,321 | | | | 347,867 | | | | 1,214,188 | | All Directors and Executive Officers as a Group (19 persons) | | All Directors and Executive Officers as a Group (19 persons) | | All Directors and Executive Officers as a Group (19 persons) | | All Directors and Executive Officers as a Group (19 persons) | | | | 258,730 | | | | 591,316 | | | | 11,462 | | | | 861,508 | | | | 227,105 | | | | 1,088,613 | |

(1) Shares owned outright. These amounts include the following shares held pursuant to YUM’s 401(k) Plan as to which each named person has sole voting power: | | ∎ | | all relevant executive officers as a group, 3,9154,091 shares |

(2) The amounts shown include beneficial ownership of shares that may be acquired within 60 days pursuant to SARs awarded under our employee or director incentive compensation plans. For SARs, we report the shares that would be delivered upon exercise (which is equal to the number of SARs multiplied by the difference between the fair market value of our common stock at year-end and the exercise price divided by the fair market value of the stock). (3) These amounts shown reflect units denominated as common stock equivalents held in deferred compensation accounts for each of the named persons under our Director Deferred Compensation Plan or our Executive Income Deferral Program and include full value awards.Program. Amounts payable under these plans will be paid in shares of YUM common stock at termination of directorship/employment or within 60 days, if so elected. (4) The amounts shown include units denominated as common stock equivalents held in deferred compensation accounts which become payable in shares of YUM common stock at a time (a) other than at termination of directorship/employment and (b) after 60 days. (5) For Ms. Domier, these shares are held in a trust.trust for which she retains voting and/or investment power. For Mr. Gibbs and Ms. Skeans, 65,893 and 7,251 of these shares are held in trusts, respectively.respectively, for trusts in which they retain voting and/or investment power. 4437

STOCK OWNERSHIP INFORMATION | | | | | | | YUM! BRANDS, INC. | | |  | | | 2024 PROXY STATEMENT |

DELINQUENT SECTION 16(A)16(a) REPORTS Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and persons who own more than 10% of the outstanding shares of YUM common stock to file with the SEC reports of their ownership and changes in their ownership of YUM common stock. Directors, executive officers and greater-than-ten percent shareholders are also required to furnish YUM with copies of all ownership reports they file with the SEC. To our knowledge, based solely on a review of the copies of such reports furnished to YUM and representations that no other reports were required, all of our directors and executive officers complied with all Section 16(a) filing requirements during fiscal 2022.2023. 4538

| | | | | | | YUM! BRANDS, INC.EXECUTIVE COMPENSATION

| | |  | | | 2023 PROXY STATEMENT

|

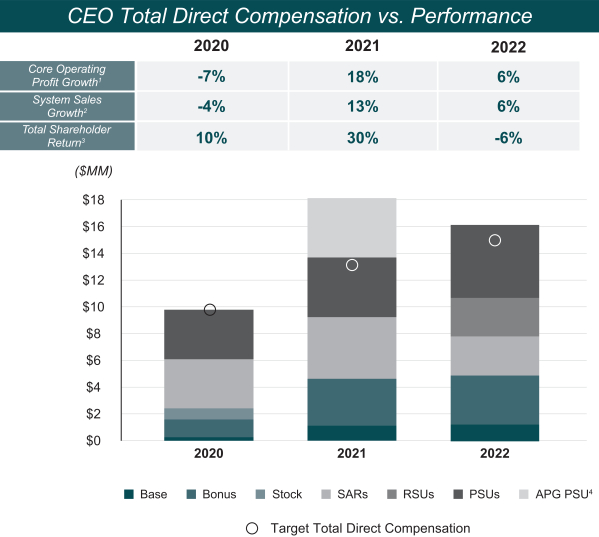

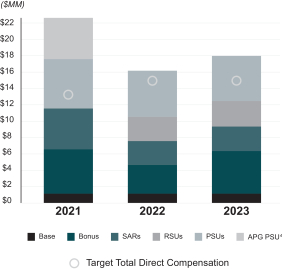

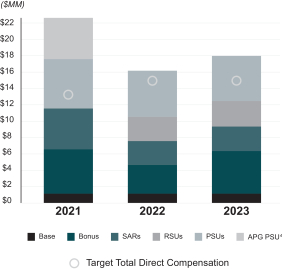

EXECUTIVE COMPENSATION Compensation Discussion and Analysis This Compensation Discussion and Analysis (“CD&A”) describes our executive compensation philosophy and program, the compensation decisions of the Management Planning and Development Committee (the “Committee”) for our named executive officers (“NEOs”) and factors considered in making those decisions. Table of Contents I. Executive Summary A. YUM 20222023 Performance The Company’s 2022 performance2023 was another very strong resultingyear for the Company, as it surpassed the $60 billion threshold in system sales and exceeded all aspects of our long-term growth ofalgorithm. In reaching this milestone, YUM achieved 6%, underpinned by 4% same-store sales Same-Store Sales growth, 12% Core Operating Profit1 growth and 4% unit growth. Notably, our unit growth set an industry record for the second year in a row. Each of our four global Brands contributed to the strength we saw in 2022 with positive system sales growth and6% net-new unit development.growth, with broad-based strength across the globe. Of note, the Company accomplished its net-new unit growth through another record year for unit development, opening over 4,700 new stores around the world. This diversified strengthperformance illustrates the continued healthcapability of our global system, driven by our iconic Brands strong unit economics and the unmatched operating capability of our committed, and well-capitalized franchise partners. In 2022, we opened 4,560 gross units, marking the strongest development year in YUM’s history and setting an industry record for unit development for the second year in a row, topping the previous record we set in 2021 of 4,180 gross units. This unit development over the last two years is a strong demonstration that our Brands are growing and that our franchisees are aligned with our growth strategy. Notably, these results were achieved even as the Company’s 2022 financial performance was adversely affected by the war in Ukraine and the decision to cease operations in Russia.

Additionally, theThe Company again reached new heights in its digital capabilities, leading to over $24$29 billion in digital sales, a meaningful22% increase over the prior yearyear. Additionally, digital sales exceeded 45% of total system sales in 2023, an all time high and a further indicator that our digital-focused consumer optionsdigital-enabled ordering channels continue to gainmature and build upon prior momentum. In 2022, weOur digital sales growth in 2023 was underpinned by the continued scaling of our digital and AI-driven ecosystem, in partnership with our franchisees, and continued to capitalize on the structural advantages of our diversified global portfolio by leveraging our unmatched global scale, sophisticated supply chains and marketing and consumer insights expertise and our still growing digital and technology capabilities to fuel growth and deliver consistently strong results.

461 See pages 31-32 and 35-36 in Item 7 of YUM’s Form 10-K for the fiscal year ended on December 31, 2023 for a discussion of Core Operating Profit in 2023

39

EXECUTIVE COMPENSATION | | | | | | | YUM! BRANDS, INC. | | |  | | | 2024 PROXY STATEMENT |

AsLooking to 2024, we move into 2023,expect this will be a year of major milestones for YUM, as we areexpect to exceed 60,000 restaurants within the YUM system globally by year end, led by 30,000 restaurants at KFC and 20,000 at Pizza Hut. Going forward, we remain confident that we will continue to build the world’s most loved and trusted brands while delivering lasting value for our stakeholders.shareholders. To accomplish these goals, we will continue to leverage our Recipe for Good Growth underStrategy, which we will continue to focus on four key growth drivers which we rely on to guide our long-term strategy and forms the basis of the Company’s strategic plans to acceleratedrive same-store sales growth and net-new restaurant development around the world. The Company remains focused on creating cravable experiences for customers and building the world’s most loved, trusted and fastest growing restaurant brands by:

| ∎ | | growing Unrivaled Culture and Talent to leverage our culture and people capability to fuel brand performance and franchisefranchisee success; |

| ∎ | | developing Unmatched Operating Capability by recruiting and equipping the best restaurant operators in the world to deliver great customer experiences; |

| ∎ | | building Relevant, Easy and Distinctive Brands by innovating and elevating iconic restaurant brands that people trust and champion; and |

| ∎ | | achieving Bold Restaurant Development by driving market share and franchise unit expansion with strong economics. |

By continually leveraging our Recipe for Good Growth Strategy — inclusive of our roadmap forgrowth drivers and our commitment to social responsibility, risk management and sustainable stewardship of people, food and planet, internally and across our supply chain and franchise system — we will elevate the importance of people and continue building an equitable and inclusive culture that, in turn, helps us better serve our customers and communities in which we operate. We remain confident into drive our business model and inimprove the strength of our iconic Brands, as we look to further accelerate our growthanother year of Good Growth in 2023.2024. 20222023 Performance Highlights1

(1) See pages 29, 3331-32 and 35-36 in Item 7 of YUM’s Form 10-K for the fiscal year ended on December 31, 20222023 for a discussion of Core Operating Profit in 2022.2023. System Sales Growth excludes impact of foreign currency translation. B. Named Executive Officers The Company’s NEOs for 20222023 were as follows: | | | Name | | Title | | | David W. Gibbs | | Chief Executive Officer | | | Chris Turner | | Chief Financial Officer | | | Mark King

| | Chief Executive Officer of Taco Bell Division | | | Tracy L. Skeans | | Chief Operating Officer and Chief People Officer | | | Sabir Sami | | Chief Executive Officer of KFC Division | | | Aaron Powell | | Chief Executive Officer of Pizza Hut Division |

4740

| | | | | | | YUM! BRANDS, INC.EXECUTIVE COMPENSATION

| | |  | | | 2023 PROXY STATEMENT

|

C. Compensation Philosophy The business performance of the Company is of the utmost importance in determining how our executives are compensated. Our compensation program is designed to both support our long-term growth model and hold our executives accountable to achieve key annual results year after year. YUM’s compensation philosophy for the NEOs is reviewed annually by the Committee and has the following objectives: | | | | | | | | | | | | | Pay Element | Objective | | Base Salary | | Annual

Performance-Based

Cash Bonuses | | Long-Term Equity

Performance-Based

Incentives | | | | | Attract and retain the best talent to achieve superior shareholder results—To be consistently better than our competitors, we need to recruit and retain superior talent — individuals who are able to drive superior results. We have structured our compensation programs to be competitive and to motivate and reward high performers. | |

| |

| |

| | | | | Reward performance—The majority of NEO pay is performance-based and therefore at risk. We design pay programs that incorporate team and individual performance goals that lead to shareholder return. | | | |

| |

| | | | | Emphasize long-term value creation—Our belief is simple: if we create value for shareholders, then we share a portion of that value with those responsible for the results. | | | | | |

| | | | | Drive ownership mentality—We require executives to invest in the Company’s success by owning a substantial amount of Company stock. | | | | | |

|

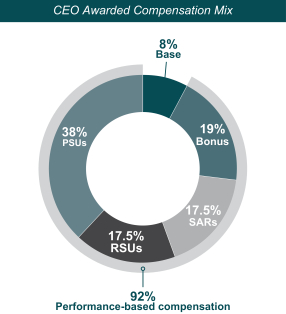

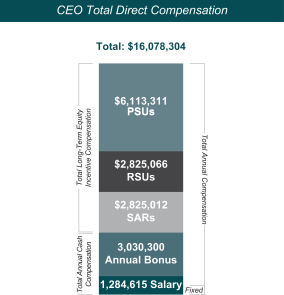

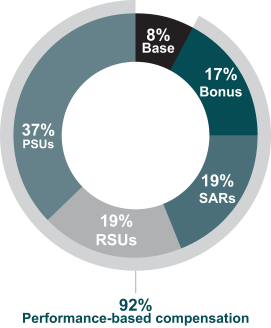

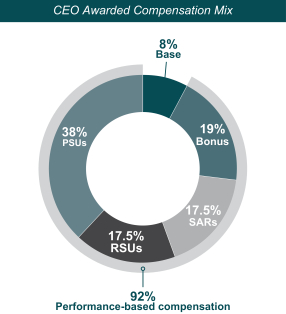

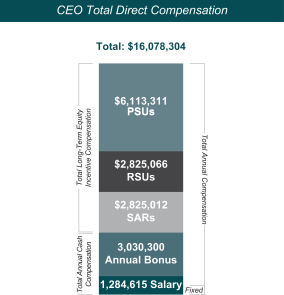

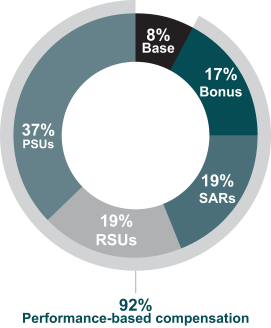

D. Compensation Overview 20222023 Compensation Highlights

| ∎ | | In January of 2022,2023, the Committee made the following decisions and took the following actions: |

| | ∎ | | The Committee continued to set our CEO target for total direct compensation (base salary, annual cash bonus and annual long-term incentive award value at grant date) at a level near the median of our Executive Peer Group (defined at page 64)55) for the CEO role; and |

| | ∎ | | The Committee continued to set the equity mix for our NEOs’ annual long-term incentive awards at 25% stock appreciation rights (“SARs”), 25% restricted stock units (“RSUs”) and 50% performance share units (“PSUs”). This change to our equity mix (formerly 50% SARs and 50% PSUs) was made in response to shareholder feedback, in alignment with our business strategy and compensation philosophy. |

| ∎ | | In February of 2022,2023, the Committee certified that our 20192020 PSU awards paid out at 88%115% of target, based on the Company’s Total Shareholder Return (“TSR”) at the 50th67th percentile compared to the S&P 500 Consumer Discretionary Index and Earnings Per Share (“EPS”) growth of 10%7.6% CAGR, for the 2019-20212020-2022 performance cycle (see discussion of PSUs at page 55)47). |

| ∎ | | Say on Pay. At our May 20222023 Annual Meeting of Shareholders, shareholders approved our “Say on Pay” proposal in support of our executive compensation program, with approximately 52%87% of votes cast in favor of the proposal. This result led to expanded outreach efforts to shareholders to ensure that the Committee was properly apprised of any concerns shareholders had with our executive compensation program with respect to decisions made in 2021 and going forward. These efforts are described in more detail immediately below and on page 61. |

| ∎ | | Shareholder Outreach. In response to the results ofWe continued our annual vote on our executive compensation program at our 2022 annual meeting of shareholders, where approximately 52% of our shareholders supported our advisory vote on executive compensation, we bolstered our longstanding shareholder outreach program efforts. Committee and management team members from compensation, sustainability, investor relations and legal proactively took steps to engage with shareholders and listen to shareholders’ feedback regarding our compensation program, including the Accelerating Profitable Growth (“APG”) PSU in 2021. This engagement allowed for us to better understand our investors’ opinions on our compensation practices and to actively respond to their questions or concerns. Our outreachquestions. Committee and management team members from compensation, investor relations and legal continued to be directly involved in engagement efforts |

48

EXECUTIVE COMPENSATION

| during 20222023 that served to reinforce our open-door policy for shareholder engagement. For 2022, these engagementpolicy. The efforts included contacting our largest 35 shareholders, representing ownership of greater thanapproximately 50% of our shares and discussing our compensation program philosophy (as well as the APG PSU), with 15 of them, representing greater than 20% ownership of the Company. The feedback received during these meetings, as well as the Committee’s reaction to that feedback, is discussed(discussed further on page 61.53). |

| ∎ | | Change in PSU Metrics.Updated Executive Stock Ownership Guidelines. Due toIn August 2023, theCommittee revised the waning negative impact of the pandemic on the Committee’s ability to set targets which include operating metrics, our annual PSU grants madeownership guidelines applicable to our executive officers in 2022 willNEOs by adding a holding requirement which provides that at least 50% of each award granted must be earned based on 50% System Sales Growth and 50% Core Operating Profit Growth targets, withheld by an NEO until his or her ownership requirement is met (see page 56 for a TSR modifier relative to the S&P 500 Consumer Discretionary Index which can increase or decrease payouts by up to 25% (but cannot result in a payout exceeding 200%)more detailed discussion).

|

The Committee determined this change was consistent with the Company’s overall business strategy, our compensation philosophy and market practice. PSUs are discussed in more detail on page 55.

2023 Changes to Compensation Program41

| | | | | | | YUM! BRANDS, INC. ∎ | |  | | | YUM Leaders’ Bonus ESG Focused Individual Factor2024 PROXY STATEMENT. Under the YUM Leaders’ Bonus plan, each of our NEO’s individual performance factor is determined by the Committee based upon its subjective determination of the NEO’s individual performance for the year, including consideration of specific objective individual performance goals set at the beginning of the year.

|

For 2022, the six performance categories considered by the Committee included: (i) Fostering Unrivaled Culture and Talent; (ii) Driving Bold Restaurant Development and Returns; (iii) Building Relevant, Easy and Distinctive Brands; (iv) Developing Unmatched Operating Capability; (v) Implementation of our Recipe for Good Growth; and (vi) Delivering on Shareholder Promises.

Beginning in 2023, our executives’ individual performance will be evaluated against a more targeted ESG-centric goal, which combines talent commitments previously captured in the Unrivaled Culture and Talent goal and certain People, Food and Planet commitments found in our Recipe for Good Growth. This intentional change is designed to drive enhanced performance against quantifiable ESG metrics and refocus and elevate the current evaluation of the implementation of our 2023 Recipe for Good Growth.

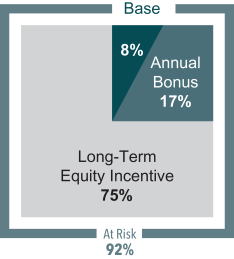

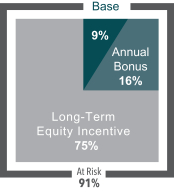

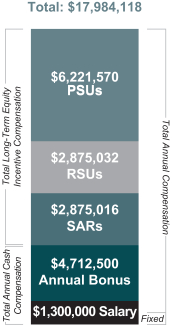

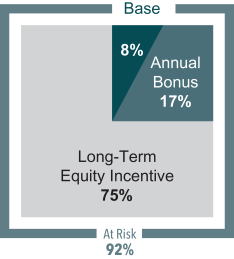

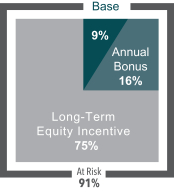

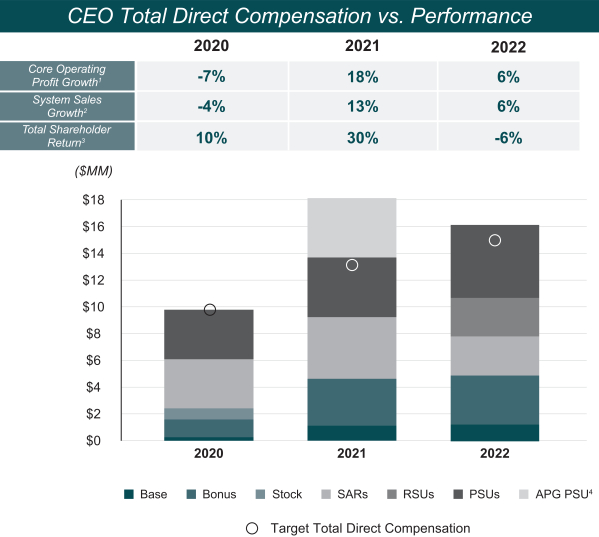

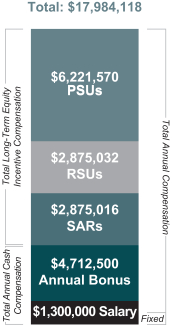

E. Relationship between Company Pay and Performance for the CEO To focus on both the short-term and long-term success of the Company, approximately 91%92% of our CEO’s annual target compensation is “at-risk” pay, with the compensation paid based on Company results. If short-term and long-term financial and operational target goals are not achieved, then performance-related compensation will decrease. If target goals are exceeded, then performance-related compensation will increase. As demonstrated below, our target annual pay mix for our CEO emphasizes our commitment to “at-risk” pay in order to tie pay to performance. The discussion in this section is limited to Mr. Gibbs, our CEO for 2022.2023. Our other NEOs’ target annual compensation is subject to a substantially similar set of considerations, which are discussed in Section III, 20222023 Named Executive Officer Total Direct Compensation and Performance Summary, found at pages 5848 to 6052 of this CD&A. 49

| | | | | | | YUM! BRANDS, INC.CEO Target Pay Mix–2023